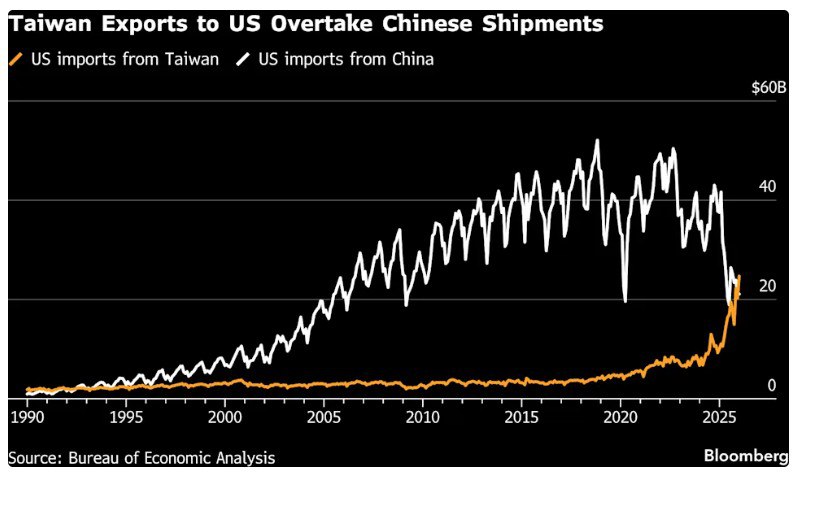

For the first time in three decades, Taiwan has surpassed China in monthly export volumes to the United States. According to the U.S. Department of Commerce, American imports of Chinese goods fell by nearly 44% year-on-year in December, reaching $21.1 billion. At the same time, shipments from Taiwan more than doubled, climbing to $24.7 billion.

Since the early 1990s, China had gradually established itself as the primary supplier to the U.S. market. Cheap labor, massive industrial capacity, advanced infrastructure, and deep integration into global value chains made Beijing a central pillar of the world economy. U.S. dependence on Chinese imports peaked in the 2010s. However, trade wars, sanctions, and growing geopolitical confrontation are steadily reshaping global supply chains. Taiwan has emerged as the main beneficiary of this transformation.

The surge in Taiwanese exports is largely driven by high-tech products: semiconductors, microelectronics, components for data centers, and artificial intelligence systems. Amid the global AI boom, demand for advanced chips has soared, and the most sophisticated production capacity remains concentrated on the island.

Last week, Taipei signed a new trade agreement with Washington. The deal reduces the base tariff rate from 20% to 15%, while semiconductor exports will be eligible for duty-free treatment within defined quotas. In effect, the United States is reinforcing Taiwan’s status as a strategic technological partner.

Against this backdrop, Taiwan’s statistical bureau significantly raised its 2026 GDP growth forecast from 3.5% to 7.7%. For a developed economy, such a level is exceptionally high. The upward revision reflects strong technology exports, increased investment inflows, and Taiwan’s expanding role in global supply chains.

If the trend continues, China’s share of U.S. imports is likely to keep declining in 2026; Taiwan’s high-tech exports may accelerate further; and global supply chains could become increasingly structured along geopolitical lines.