‘If you want to trade with the United States, stop trading with China.’ Many countries are now facing this dilemma. One of them is Mexico, which ultimately chose to trade with the United States.

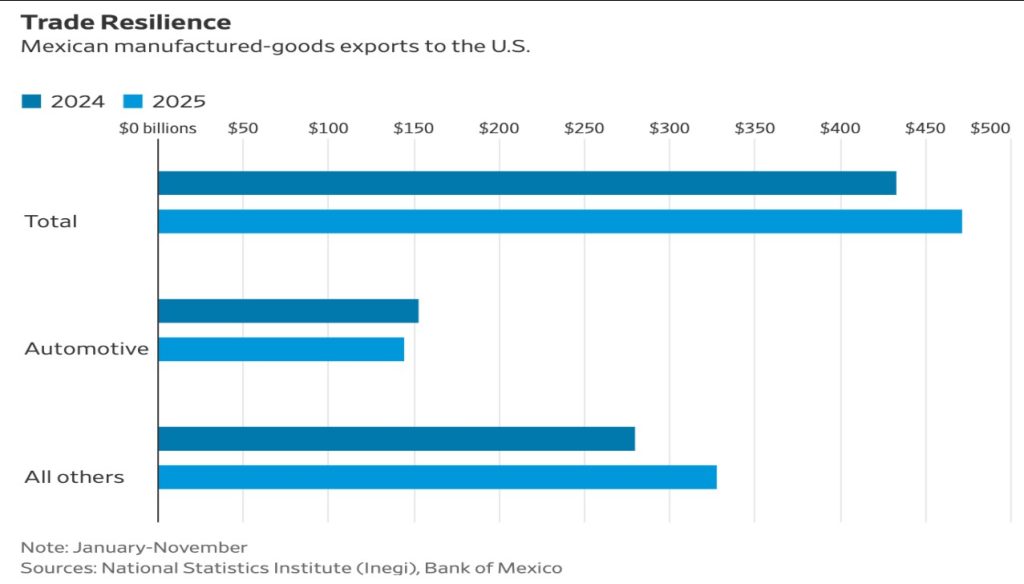

Despite the maintenance and even strengthening of US customs duties on cars, steel and aluminium, Mexican exports of industrial products to the United States increased by 9% between January and November compared to the same period in 2024. Car exports to the United States fell by nearly 6% during this period, but this decline was not critical. Exports of other industrial products rose by 17%, offsetting losses in the automotive sector and consolidating the shift within Mexican industry.

Total trade between the United States and Mexico is expected to reach nearly $900 billion, which would be a historic record. In addition, Mexico has already offset approximately 25% of the reduction in the US trade deficit with China.

December’s tariff reversal was a decisive step. The Mexican Senate approved a law imposing tariffs of 5% to 50% on more than 1,400 products from Asian countries that have not signed trade agreements with Mexico. Chinese cars were subject to the maximum tariff of 50%. Tariffs on products from Chinese markets increased to 33.5%.

Mexico is deliberately limiting Chinese presence in its market, thereby supporting the US strategy of putting pressure on Beijing. At the same time, around 85% of Mexican exports remain exempt from customs duties under the USMCA. In other words, Mexico is gaining access to the US market in exchange for reducing its economic ties with China and Asia in general.

En fin de compte, nous constatons que dans la nouvelle réalité géoéconomique, le commerce devient le prolongement de la politique.