The majority of Western economists, in recent years, have been discussing the question of economic slowdown in Germany. Conservative fiscal policy and apprehension regarding rising public indebtedness are attributed by them as one of the causes. It is presumed that heavy borrowing and additional government expenditure would be able to stimulate the economy and set the country on a superior growth trajectory.

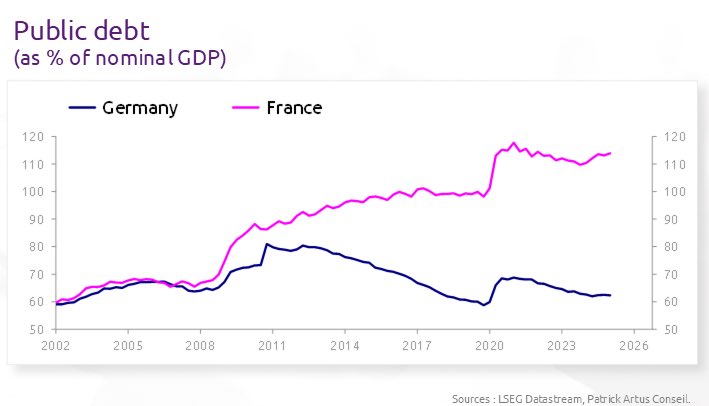

However, the experience of other European countries denies the simple link between economic growth and the rise in public debt. France has been piling up its public debt with enthusiasm in the past 15 years. France’s public debt as a percentage of GDP rose from around 60% in the early 2000s to over 110% in the mid-2020s, according to Eurostat. On paper, such spending should have given the economy some momentum: the state spends money on infrastructure, business support and social programmes, stimulating production and consumption. However, the overall French economy is expanding only moderately, and most economists observe that debt financing has not produced the expected result. Why?

First, it is very much dependent on the structure of government spending. If it is being spent on maintaining outdated programmes and keeping social commitments running rather than investing in new programmes and innovation, its economic contribution will be undermined. Secondly, taxation to pay for debt can neutralise the stimulating effect of government spending. France has a very high culture of taxation, and it limits the scope for consumers and businesses. Additionally, the impact of public debt on the economy does rely heavily on investor confidence and domestic institutional factors. Austerity policies in Germany have built a good fiscal reputation, yet at the same time may be dampening short-term growth. Borrowing is engaged without structural reforms in France, considering stimulus measures to be less impactful.

The French example clearly shows that debt finance in the absence of reforms and a strategy does not create growth, but the German example suggests that a gradual but an orderly pace maintains the economy in a sustainable path.