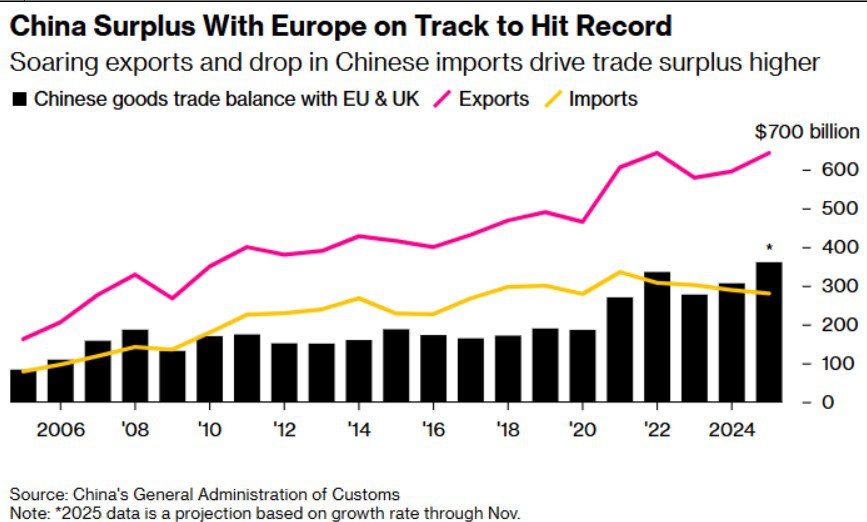

In 2025, China’s trade surplus with the European Union is approaching the $300 billion mark. Chinese exports to the EU now exceed imports by more than two to one, and this gap continues to widen. The main reason is that Chinese manufacturers are actively redirecting goods previously destined for the U.S. market, now subject to American tariffs, toward Europe.

European industry under pressure

As recently as 2019, China ran a trade deficit of around $25 billion with Europe’s largest economy. However, over the first eleven months of the current year, the situation has changed dramatically: the balance has turned into a surplus of roughly $23 billion per month. This shift has occurred primarily due to a sharp decline in European imports from China combined with an aggressive expansion of Chinese exports.

Political reactions in Europe are becoming increasingly tough. French President Emmanuel Macron has openly described the trade imbalance with China as “unsustainable,” stressing that it has become a matter of life or death for European industry. European Commission President Ursula von der Leyen has expressed a similar view, stating that EU–China relations have reached a turning point. Chinese products (from electronics to automobiles) are displacing traditional European industries, particularly mechanical engineering and automotive manufacturing, depriving the EU not only of jobs but also of technological sovereignty.

L’exemple du Mexique

Mexico has become one of the most illustrative cases. In 2025, the country approved tariffs of up to 50% on Chinese automobiles and on roughly 1,400 additional product categories, ranging from sneakers to microwave ovens. The new rate is more than double the previous 15–20% and represents the maximum level permitted under WTO rules. While the measures formally apply to a broad range of goods, the primary impact clearly targets China’s automotive sector. According to official data, Chinese products account for about 20% of Mexico’s total imports, and in November, one in five cars sold in the country was manufactured in China. In the first half of the year, Mexico even became the world’s largest buyer of Chinese-made vehicles.

La réponse européenne à la montée des exportations chinoises

Unlike Mexico, however, Europe has another potential way to counter the surge in Chinese exports: restoring economic relations along its eastern flank. In 2019, EU–Russia foreign trade amounted to $277.8 billion, with Russia running only a minimal surplus of $4.8 billion for the year, even under sanctions. In pre-sanctions 2013, EU–Russia trade exceeded $410 billion, with Europe accounting for nearly half of Russia’s total foreign trade. This was supplemented by trade with Belarus of around $16 billion.

Trade between the EU and Ukraine should also be taken into account. In 2013, their trade volume reached $140 billion, of which $77 billion consisted of imports of European goods. By 2024, this figure had fallen to $60 billion, meaning Europe is missing out on roughly $80 billion in trade turnover.

Taken together, European exports to Russia, Belarus, and Ukraine during periods of normal relations amounted to around $300 billion per year. Adjusted for dollar inflation, this would exceed $350 billion in today’s prices, roughly comparable to the EU’s current trade deficit with China.