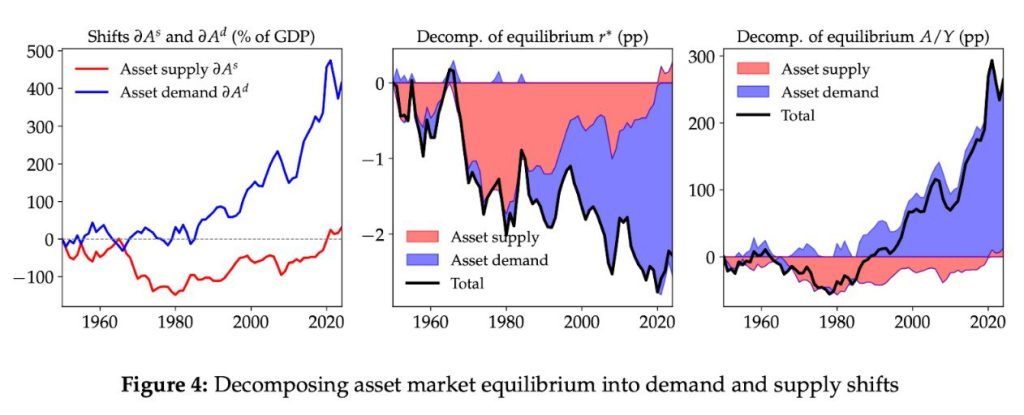

Over the past few decades, the American economy has faced fundamental changes in the balance between supply and demand for financial assets. While the supply of assets in the US, expressed as a percentage of GDP, has doubled since 1982, demand for them has quadrupled. This shift has been a decisive factor influencing both interest rate dynamics and the debt sustainability of the state.

Until the late 1960s, changes in asset supply and demand remained relatively insignificant. However, starting in the 1970s, the situation began to change. In the early 1980s, asset supply declined significantly, after which both curves, supply and demand, rose. The key difference lies in the scale of growth: while the supply of assets increased by approximately 100% of GDP, demand increased by almost 400% of GDP.

The growth in demand for assets in the United States was driven by several structural processes. An ageing population led to an increase in pension savings and heightened interest in financial instruments with long-term returns. Increasing social inequality, accompanied by the concentration of wealth in the upper echelons of society, also contributed to the growing demand for investment assets. An additional factor was foreign demand: global investors viewed American assets as reliable, which increased pressure on the market. Finally, slowing labour productivity growth limited income growth, prompting households and companies to seek alternative forms of accumulation more actively.

From the early 1980s, growing demand for assets became the main factor driving down interest rates. The excess of capital relative to the limited supply of financial instruments put downward pressure on yields. At the same time, this phenomenon was accompanied by a rise in the cost of credit, which changed the financial behaviour of both households and corporations.

Today, the key challenge for the US is the sustainability of public debt. It is estimated that fiscal consolidation of more than 10% of GDP will be required to stabilise it. However, thanks to continued high demand for US assets, public debt could rise to 250% of GDP without causing a sharp rise in interest rates.