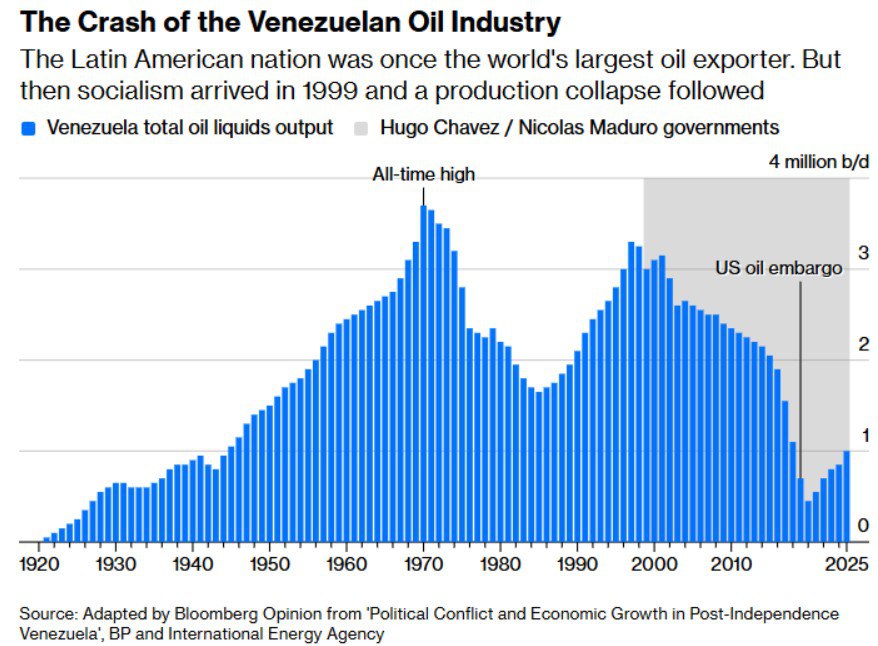

Once, Venezuela ranked among the world’s largest oil producers, and its exports formed the backbone of national prosperity. However, after Hugo Chávez came to power in 1999, an era of socialist reforms, nationalizations, and state-controlled economic management began. The result was the deterioration of PDVSA, the exodus of skilled professionals, chronic underinvestment, and ultimately a catastrophic collapse in production. In 2020, Venezuela hit a century-low level, barely 450,000 barrels per day.

Against this backdrop, a widely held belief emerged that the future of Venezuelan oil looks hopeless. Skeptics argue that the industry has been so badly damaged that its recovery would require decades and enormous financial investments. Yet Bloomberg economist and commodities analyst Javier Blas offers a far more pragmatic assessment. According to him, Venezuela could increase production by 300,000 to 500,000 barrels per day within the next 12 to 18 months without the need for massive capital spending.

The key factor lies in the existence of so-called “easily accessible” reserves. This refers to high-quality oil that can be extracted without complex technologies or multi-billion-dollar investments. These resources make it possible to relatively quickly bring idle wells and abandoned infrastructure back online. Essentially, this represents the potential for a rapid recovery based on existing capacity that has remained neglected for years.

Blas notes that he has witnessed similar scenarios several times throughout his nearly 30-year career in the industry. He cites Iraq after 2003, Libya after 2011, and Iran between 2021 and 2023 as examples. Moreover, Venezuela itself has already demonstrated its ability to stage an unexpected rebound. After production collapsed in 2020, few expected a meaningful recovery, yet output nearly doubled within five years. Now, according to the analyst, following a potential fall of the Maduro regime, the country could once again surprise markets in the short term.

Nevertheless, Blas does not indulge in excessive optimism. He clearly points out that surpassing the threshold of 1.2 to 1.3 million barrels per day would represent an entirely different challenge. At that stage, major investments, refinery modernization, pipeline rehabilitation, and the involvement of international oil companies would become indispensable. Venezuela’s main reserves are concentrated in the heavy and extra-heavy crudes of the Orinoco Belt, whose development requires complex technologies, long-term contracts, and a stable political environment.