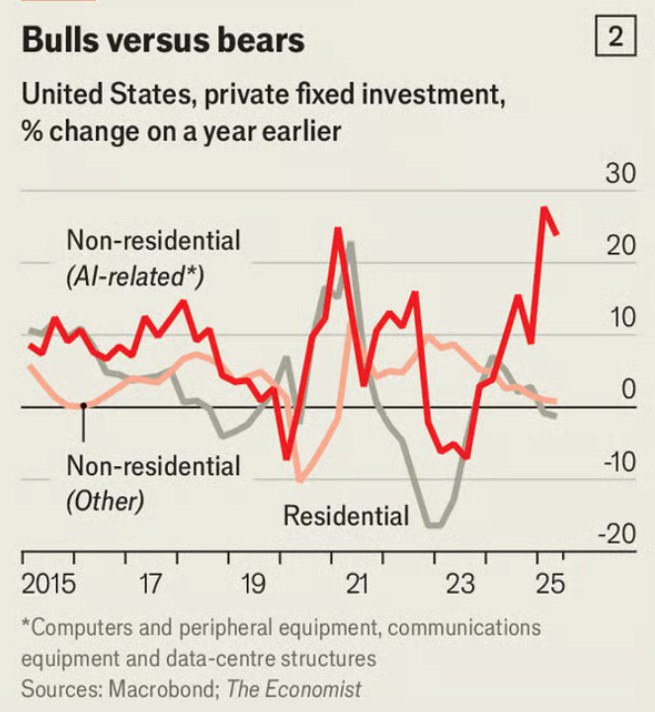

In 2025, the American economy is showing a curious paradox. The main driver of growth is simultaneously becoming a factor of pressure on other industries. Approximately one-sixth of the 2% increase in real GDP over the past year was attributable to investments in computer and communications equipment, from chips to data centres. If we add to this the modernisation of the networks needed to power artificial intelligence models, as well as the increase in the value of software intellectual property, then, according to one estimate, AI’s contribution to overall economic growth reaches an impressive 40%.

Yet, however, such rapid expansion has its hidden cost. The high-tech sector, which accounts for the lion’s share of the growth, is simply pushing out other sectors. Higher interest rates, which many technology companies can offset thanks to high revenues and investment attractiveness, are becoming critically burdensome for traditional developers and businesses not related to AI.

Additional pressure is coming from the energy sector. Data centres that power AI models consume enormous amounts of electricity, keeping energy prices high. As a result, average electricity bills in the United States rose by 7% in 2025. At the same time, real consumption in the economy has stabilised since December, indicating limited growth in traditional sectors. Housing construction has slowed down, and investment in non-AI firms is diminishing. In the meantime, a balance between innovation investment and financing the real sector is more crucial to long-term viability.