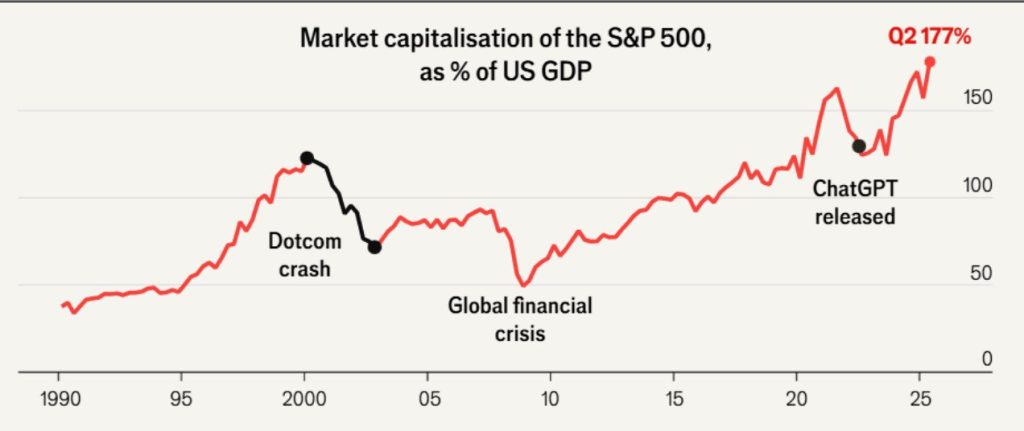

The total capitalisation of the American stock market has reached an all-time high. Companies in the S&P 500 index are now worth around 177% of US GDP. The current growth is driven by the rapid expansion of artificial intelligence, which has become the main investment magnet in recent years. However, what looks like a technological breakthrough today could easily turn into the biggest financial bubble of the 21st century.

If a crash occurs on a scale comparable to that of 2000–2002, the impact on American households will be much deeper than in previous cycles. Over the past two decades, the stock market has become accessible to the general public: zero commissions, automatic pension plans and the popularity of ETFs have virtually eliminated the barrier. As a result, Americans hold about $42 trillion in stocks, which is about one-fifth of the nation’s total wealth. This is significantly more than in the dot-com era, when stock assets accounted for about one-sixteenth of the population’s wealth. Foreign investors additionally hold about $18 trillion in US stocks, making a possible crash not only an American problem, but a global one.

A decline in capitalisation on a scale similar to that seen during the dot-com bubble would wipe out approximately $16 trillion in wealth for American households and around $7 trillion for foreign investors. Moreover, these estimates do not take into account indirect consequences. Pension funds, insurance companies and corporate pension plans have accumulated another $20 trillion, which would also be subject to revaluation.

A decline in stock wealth historically leads to a decline in consumption, and the American economy is more dependent on consumer demand than any other major economy in the world. For every $100 lost in stocks, there is an average decline in spending of about $3. If we apply this ratio to a possible AI crash, consumption in the US would fall by close to $890 billion, or nearly 3% of GDP. This is already the level of a full-blown recession, caused not by a banking crisis or a real estate crash, but by a revision of expectations regarding new technology.

The paradox of the current situation is that the rapid growth of AI companies is based on the belief in increased productivity, which the market has already priced in. However, such efficiency can only be realised partially and with a significant time lag. An additional risk is the concentration of capital in a narrow group of companies that determine the dynamics of the entire index. If one sector begins to correct, the entire market follows suit. This is compounded by geopolitical factors, as the US, EU and China are simultaneously preparing increasingly stringent regulations on artificial intelligence, which could dramatically change the assessment of the industry’s prospects.