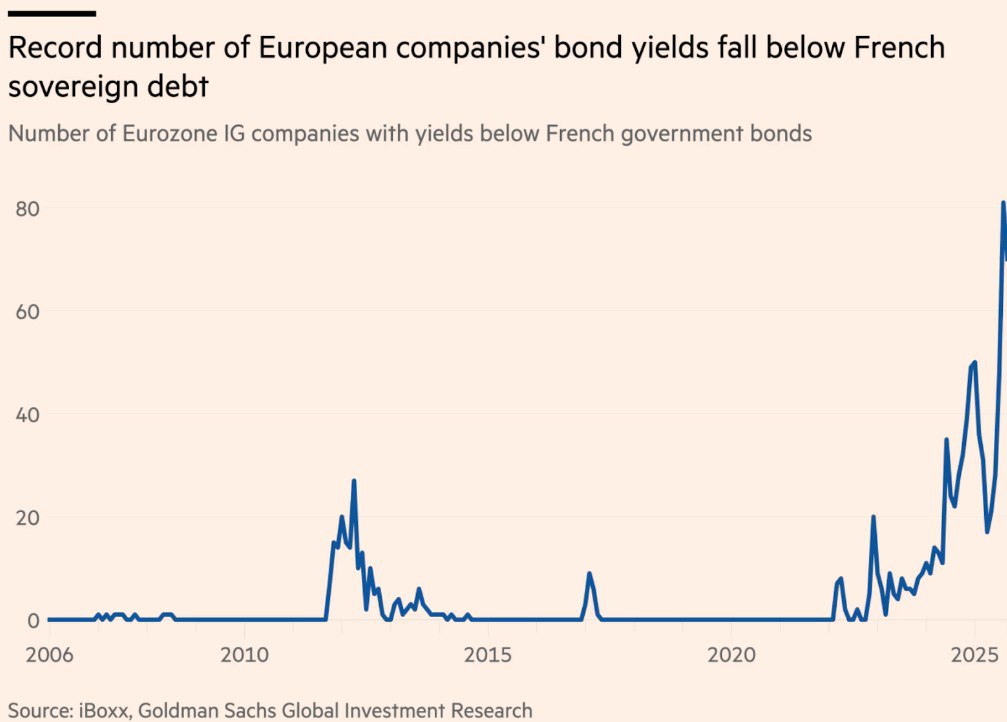

The yield on bonds issued by major French corporations has fallen below that of government securities. According to Goldman Sachs, bonds issued by companies such as L’Oréal, Airbus and Axa are trading at yields lower than those of French sovereign debt with similar maturities. Moreover, only ten French companies have recently entered the so-called negative spread zone relative to government securities.

Traditionally, government bond yields serve as the baseline for assessing corporate risk. Corporations must offer investors a risk premium compared to the state. This is especially true in the eurozone, where German bonds are the ‘gold standard’ for risk-free investments. Securities from peripheral countries trade at a premium to the German benchmark.

French sovereign debt has traditionally been considered relatively safe, especially given France’s status as the eurozone’s second-largest economy. However, the current situation shows that a number of leading private sector corporations are now perceived by investors as more reliable borrowers than the state itself.

For investors, the rise in political instability in France means uncertainty about future fiscal policy. This is especially true given that France is already facing problems of high debt and deficits. In these conditions, international corporations with diversified revenues and strong positions in global markets appear to be a more reliable choice.